does the irs write off tax debt after 10 years

After that the debt is wiped clean from its books and the IRS writes it off. Yes indeed the length of time the IRS is allowed to collect a tax debt is generally limited to ten years according to the statute of limitations on.

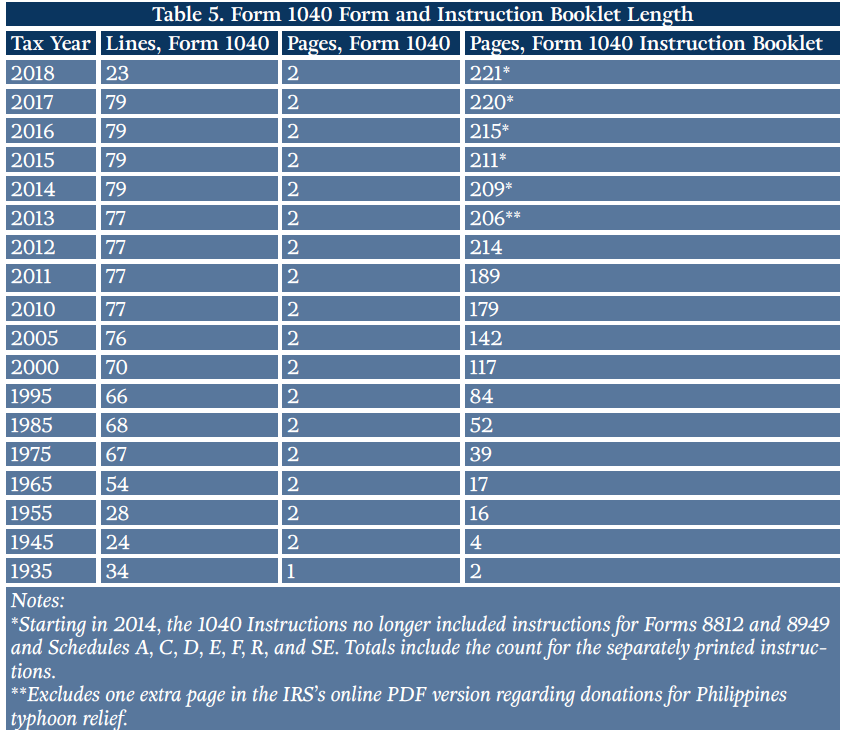

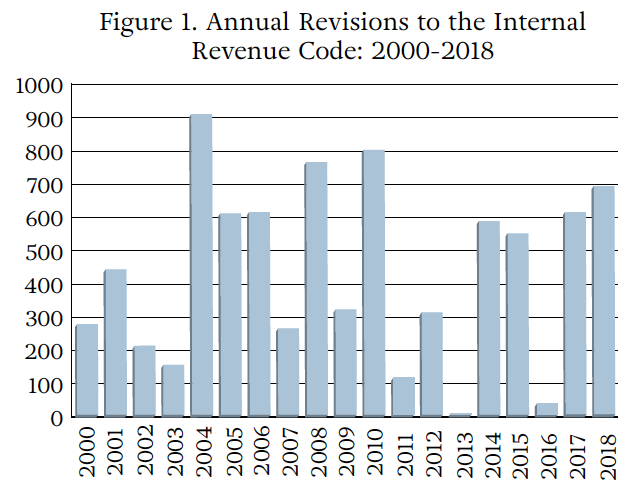

Tax Reform Bill Made Modest Progress Toward Simplification But Significant Hurdles Remain Foundation National Taxpayers Union

Is IRS debt forgiven after 10 years.

. Yes indeed the length of time the IRS is allowed to collect a tax debt is generally limited to ten years according to the statute of. The debt is wiped from the books by the IRS. Does Irs Forgive Tax Debt After 10 Years.

Does the IRS forgive back taxes after 10 years. 465 47 votes In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt. In this event the.

Does the IRS write off tax debt after 10 years. The day the tax debt expires is often referred to as the. In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt.

As already hinted at the statute of limitations on IRS debt is 10 years. After 10 years the IRS can write the debt off and clear it from their books. Therefore many taxpayers with unpaid tax bills are unaware this statute of limitations exists.

If accepted by the IRS then that means that once you pay off. This is called the 10 Year Statute of Limitations. After that time has expired the obligation is entirely wiped clean and removed from a.

As a general rule of thumb the IRS has a ten-year statute of limitations on IRS collections. If you prove to the IRS this is the first time you have been in a. For example if your tax debt is 10000 and you offer them 5000 in an offer in compromise they will consider it.

In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt. Its not exactly forgiveness but similar. If this is the first time youve owed the IRS money you can request a first-time abatement.

This means that under normal circumstances the IRS can no longer pursue collections action against you if. September 21 2022 Jessie. The Collection Statute Expiration Date CSED is the date ten years from when the tax got assessed and when the IRS writes off the debt.

Generally speaking the Internal Revenue Service has a maximum of ten years to collect on unpaid taxes. If accepted by the IRS then that means that once you pay off. Does the IRS forgive back taxes after 10 years.

However the waiting it out strategy is. Unfortunately that 10-year timeline is. However some crucial exceptions may apply.

Limitations can be suspended. The IRS has 10 years to collect taxes that are not paid. Put simply the statute of limitations on federal tax debt is 10 years from the date of tax assessment.

The IRS generally has 10 years to collect on a tax debt before it expires. In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt. After that the debt is wiped clean from its books and the IRS writes it off.

After that the debt is wiped clean from its books and the. If you prove to the IRS this. Does the IRS Forgive Tax Debt After 10 Years.

After that the debt is wiped clean from its books and the IRS writes it. This is called the 10 Year. Many people feel tempted to wait out the 10 years to not pay the debt.

Once you receive a. For example if your tax debt is 10000 and you offer them 5000 in an offer in compromise they will consider it. Yes indeed the length of time the IRS is allowed to collect a tax debt is generally limited to ten years according to the statute of limitations on.

This means the IRS should forgive tax debt after 10 years.

When Does An Irs Tax Lien Expire Rjs Law Tax And Estate Planning

Offer In Compromise Internal Revenue Service

Does The Irs Forgive Tax Debt After 10 Years

Does The Irs Forgive Tax Debt After 10 Years Heartland Tax Solutions

What Should You Do If You Haven T Filed Taxes In Years Bc Tax

Does The Irs Forgive Tax Debt After 10 Years Sort Of Tax Attorney Explains Expiring Tax Debts Youtube

/cloudfront-us-east-1.images.arcpublishing.com/gray/77LGGDMSDBBLVJIBVLRN2KQCZQ.jpg)

Top Tax Write Offs That Could Get You In Trouble With The Irs

Does The Irs Forgive Tax Debt After 10 Years

The Irs Cashed Her Check Then The Late Notices Started Coming Propublica

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service

Why Does The Irs Only Have 10 Years To Collect Debt Pocketsense

What Taxpayers Must Know About The Irs 10 Year Statute Of Limitations Landmark Tax Group

Tax Reform Bill Made Modest Progress Toward Simplification But Significant Hurdles Remain Foundation National Taxpayers Union

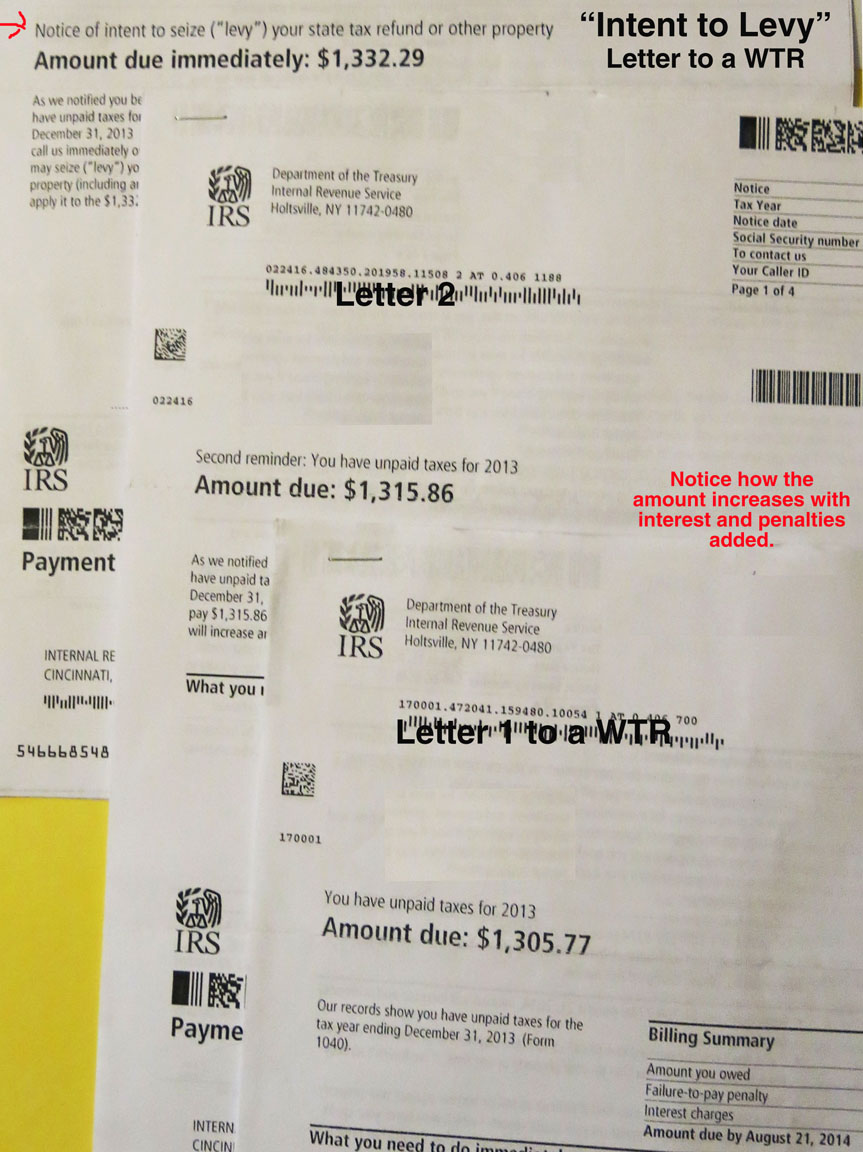

More On Irs Collection Tactics National War Tax Resistance Coordinating Committee

What Taxpayers Must Know About The Irs 10 Year Statute Of Limitations Landmark Tax Group

Rebuilding Irs Would Reduce Tax Gap Help Replenish Depleted Revenue Base Center On Budget And Policy Priorities

Are There Statute Of Limitations For Irs Collections Brotman Law

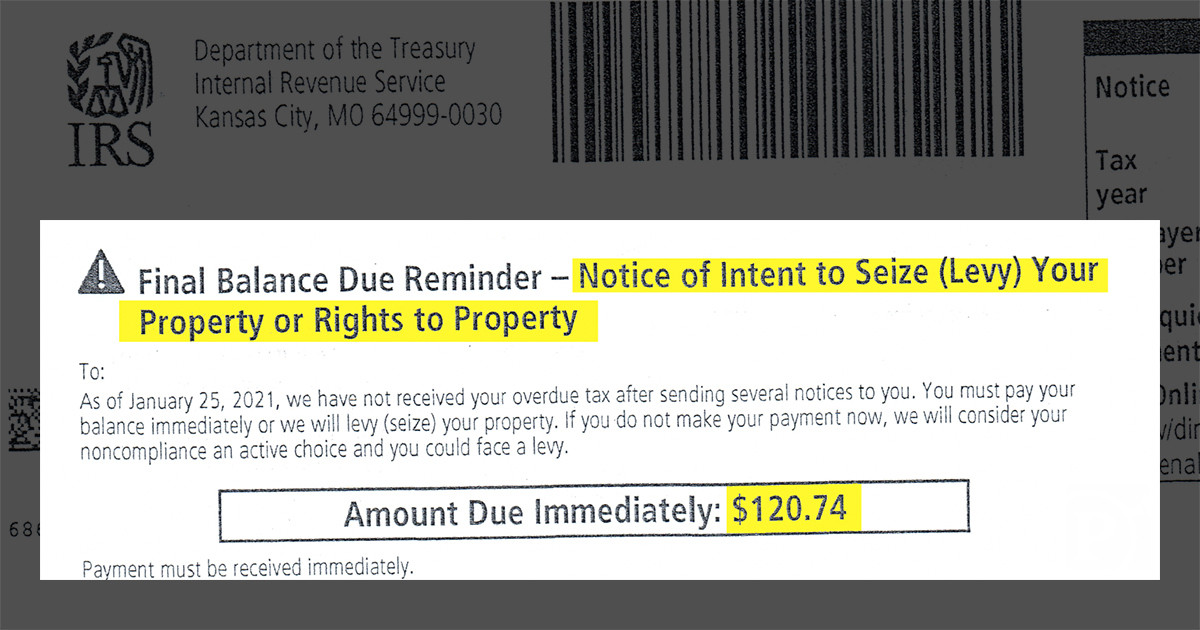

What Assets Can The Irs Legally Seize To Satisfy Tax Debt Paladini Law